As Fork Concerns Reemerge, Bitcoin Price Dives to $3,675

Since August 17, where Bitcoin price goes up to as high as $4,492, the bitcoin price has entered a steady decline. In the past several weeks Bitcoin was tested to be $4,000, but Bitcoin managed to hold above that threshold.

Since August 17, where Bitcoin price goes up to as high as $4,492, the bitcoin price has entered a steady decline. In the past several weeks Bitcoin was tested to be $4,000, but Bitcoin managed to hold above that threshold.

Price of Bitcoin Drops to $3,675

Yesterday morning, that threshold was tested again when the Bitcoin price dove by more than $300 within a few hours. Bitcoin goes to as low as $3,675 during the skid; this was its lowest value since August 12. This price suddenly bounced back to $3,800 and has a slight back up to a present value of $3,933. The market cap of Bitcoin is now $65 billion.

Segwit2x Fork Concerns Reemerge

Crypto markets are controlled and affected by so many factors, but it is likely that remaining concerns over Segwit2x are positioning some downward force on Bitcoin. The ascending discourse was not yet solved when Bitcoin cash diverges away to mold a new coin, but many investors put those worry on the back-burner during the early August bull run.

The level headed discussion reemerged as a noteworthy worry throughout the end of the week when BitPay posted a dubious blog entry advising their customers they expected to update their hubs from Bitcoin Core (non-Segwit2x) to btc1 (Segwit2x) in arrangement for Segwit initiation. Segwit2x has far reaching support among mineworkers, however it is vociferously contradicted by the Bitcoin Core engineers, and in addition a noteworthy segment of the group on the loose. The post started a web-based social networking storm, and btc1 engineer Jeff Garzik was expelled from the Bitcoin Core archive on Github.

Bitcoin weathered the August 1 bitcoin money split with little inconvenience, yet the Segwit2x hard fork could be significantly more combative. Both Bitcoin Core and Segwit2x designers guarantee that their variant is "Bitcoin" and the other is definitely not. This will without a doubt make client disarray if the group does not achieve accord when Segwit2x conveys. To exacerbate the situation, neither gathering of engineers is anxious to execute replay assurance, which would keep aggressors from broadcasting an exchange on both system chains

Core does not have any desire to actualize this security since it would require a hard fork, and– they claim– Segwit2x ought to be the one to include it since they are the ones splitting far from the primary blockchain. Segwit2x designers, then again, need to stay away from the appearance that they are making an altcoin.

Garzik and other Segwit2x defenders say that their proposition has the most help (as hash control), so Core should include replay insurance on the off chance that they need to keep on existing as a "minority chain" after bitcoin executes Segwit2x.

Asian Currency Pairs Give BTC Support

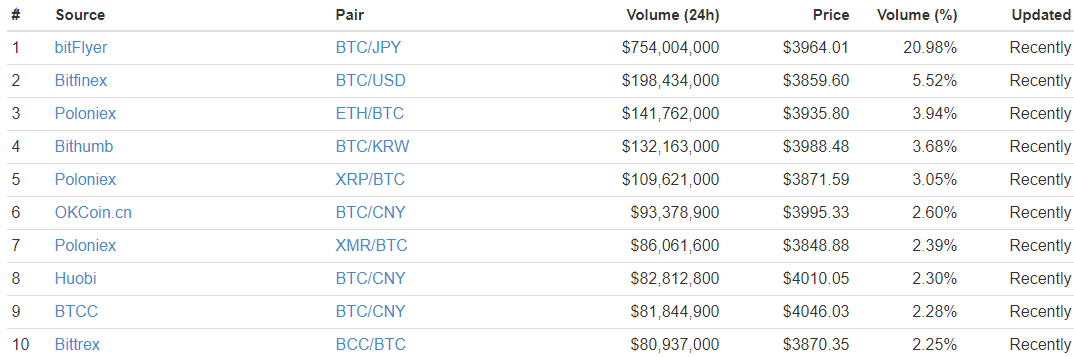

Were it not for bitcoin's Asian cash matches, the bitcoin cost would likely be fundamentally lower. BTC is at present exchanging underneath $3,900 on Bitfinex, Poloniex, and Bittrex (despite the fact that ETH/BTC is at $3,936 on Poloniex). In any case, the vast majority of bitcoin's Asian money sets stay nearer to $4,000.

Over 20% of bitcoin's every day exchanging volume is focused on bitFlyer, Japan's biggest trade; BTC/JPY represents more than $750 million of bitcoin's assessed $3.6 billion 24-hour volume. This combine is at present valued at $3,964, well over the CoinMarketCap normal. On Bithumb– South Korean's biggest exchange– BTC/KRW is exchanging at $3,988, while BTC/CNY is close or above $4,000 at OKCoin, Huobi, and BTCC.

Above images Credits to Josiah Wilmoth

Thank You So Much For Reading

Don't forget to hit upvote

Feel free to comment down what's on your mind

I LOVE STEEMIT

Don't forget to hit upvote

Feel free to comment down what's on your mind

I LOVE STEEMIT

Comments